Who were the owners of the Kielland rig?

The ownership structure behind the Alexander L. Kielland and Henrik Ibsen rigs was complex and involved several companies. To explain this, a historical review may be useful.

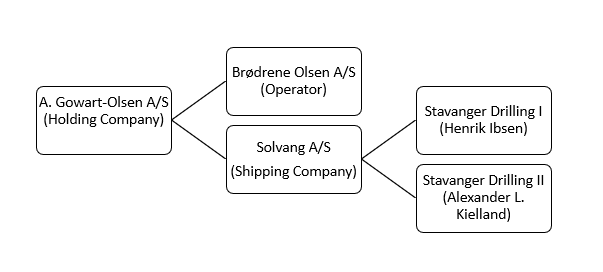

Both the Alexander L. Kielland and its sister rig, Henrik Ibsen, were managed by Stavanger Drilling, with director Alf Kaasen and chairman Sverre Bjørn-Nielsen at the helm. However, it was the shipping company Brødrene Olsen A/S that ordered the rigs through the holding company A. Gowart-Olsen A/S and the ship-owning company Solvang. The rigs cost approximately 200 million French francs each, placing them in a price range that required substantial external capital. Favorable financing arrangements contributed to many shipping companies venturing into the oil industry from the 1970s onward. Brødrene Olsen A/S was one of these companies. Like most others, they had no experience in building oil rigs. However, they had learned from past mistakes and knew how to contract and finance new projects.

The Brødrene Olsen shipping company was first registered in Stavanger on June 12, 1911, by brothers Gudmund Andreas (1871-1930) and Johannes Olsen (1886-1948). They achieved significant success before difficult times and some overly optimistic investments led to company bankrupcy in 1921. One of the brothers, Gudmund A. Olsen, had the foresight to transfer some assets to his wife, enabling him to quickly reestablish the firm Brødrene Olsen. The other brother, Johannes, became an economic refugee and spent many years in Latin America to avoid creditors and debt imprisonment.

The new Brødrene Olsen shipping company was organized as a joint-stock company. Additionally, the ships were also registered as separate companies, reducing the risk of personal bankruptcy.

Gudmund A. Olsen’s son, Alf Gowart-Olsen (1912-1972), inherited the family business from his father. The shipping company was then organised with the holding company A. Gowart-Olsen, which owned the shipping company Brødrene Olsen A/S, and several ships in separate shipowning companies. The holding company offered some advantages, particularly in terms of flexibility in relation to tax, profits, investments, risk diversification and future sales.

When Alf Gowart-Olsen passed away in 1972, Brødrene Olsen A/S was one of Stavanger’s largest and most reputable shipping companies. At this point, it was the manager Sverre Bjørn-Nielsen who led the family business. He took the company in a new direction by selling ships to finance the construction of oil rigs.

On September 11, 1973, A. Gowart-Olsen & Co, through the ship-owning company Solvang, entered into a contract with the French shipyard C.F.E.M. in Paris for the construction of two drilling rigs of the Pentagone type. The agreement was made on behalf of two limited partnerships that were in the process of being established.

A limited partnership is a type of company that has two types of participants: one responsible for everything that happens in the partnership(general partner) and investors who are only responsible for a specific sum of money (limited partner). The latter guarantees an amount that is often greater than what they actually pay. However, they still receive tax benefits calculated for the entire guaranteed amount. This arrangement provided investors with tax benefits, and a thriving petroleum industry attracted investors.

Thus, two limited partnership companies were established, one for each of the rigs to be built. Stavanger Drilling I for “Henrik Ibsen” and Stavanger Drilling II for “Alexander L. Kielland.”

“Henrik Ibsen,” Pentagone 88, was delivered in February 1976, and “Alexander L. Kielland,” Pentagone 89, was delivered on June 5th of the same year. Gowart-Olsen & Co (Solvang) owned 20 percent in the Stavanger Drilling KS companies, as did Storebrand. Platou Investments and the shipping companies Klaveness, Mosvold, Brøvig, Selvig, Jebsen, among others, owned the rest.

Further reading:

Board minutes from Stavanger Drilling II arranged retroactively:

https://media.digitalarkivet.no/view/90927/67

A short overview of applicable tax regulations regarding limited partnership companies:

https://media.digitalarkivet.no/view/90948/575

Letter of contract for the order of the two rigs, adressed to the stockholders of Solvang:

https://media.digitalarkivet.no/view/109835/16

arrow_backThe Construction ProcessWhat was it like onboard Alexander L. Kielland?arrow_forward